ULI Fall Meeting Takeaways

November 4, 2019Thursday, September 19, 2019

Washington, DC

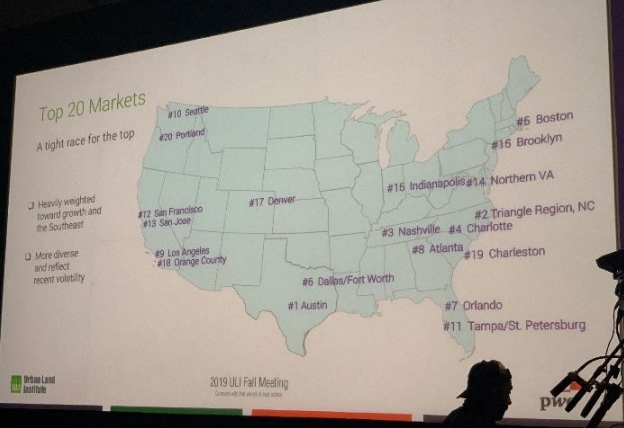

Emerging Trends

- Wage growth is one of the top major factor you need to look at by geography to identify

market opportunities at this stage of the market cycle. - Occupations driving wage growth are an additional factor you need look at when

targeting markets during this stage of the market cycle. - Example City – Austin’s pop growth is 3 times higher than the national average.

- Knowledge towns are a market opportunity because of the talent hubs being supported

by corporations and educational institutes, these maybe more resilient in the event of a

downturn in the future. - The broader trends are important but you really have to look more at deals on a case by

case basis than just population sizes of cities when comparing the two at that level. The

tier 1,2,3 cities have become less of a factor. - Hipsturbia – a trend of the younger generation bring their more urban interests into the

suburban community for things like breweries, vegetarian food, coffee shop, walkability,

village squares etc there a real opportunity to create urban environments in the

suburbs.

Fastest growing neighborhood in Washington DC – The Yards and Capital Riverfront.

- Quality of life and urbanization are the primary reasons why it has grown and expecting

continued growth. - It’s mainly millennials, remote workers and government contractors. These

communities are highly amentized. Lots of rooftop garden terraces, pools and gyms.

Several with conference rooms and one with a basketball court shared among several

buildings. - Instagram local influencer campaign was successful in getting more tenant leases

Residential Neighborhood Development Council Meeting

- Washington’s DC Market – National factors are impacting the market similarly to the rest

of the country - Government shutdowns impact DC local real estate economy substantially.

- Buyers have become more decerning. They are waiting on the right property.

- Lower price points increasing at a higher rate

- Luxury market starting to soften in DC $1M+

- Correlation between pop growth and home prices are not very correlated

- In DC, Boomers are living in their homes longer.

- 30% additional cost due to DC’s regulatory environment

- I-Buyer Platform – Lenner taking the lead on buying homes online

- Zillow Offers – Amazon is an ethos at Zillow. Ondemand services needed. 38% think

about new construction when they consider a buying a home but only 12% do

afterwards. - Lennar – trade in trade up program, rolled out open door across 20 markets

- Zestimate turning into instant offer

- Where are the risks?

- Low offers is an issue for builder referrals

- Realtors relationships is a struggle

- Zillow would like to purchase 5,000 units per month.

- Brokers are having to lower their commissions to compete with the Zillow Offers and

OpenDoor.